March 09, 2010

It

Doesn't Rhyme With 2001.

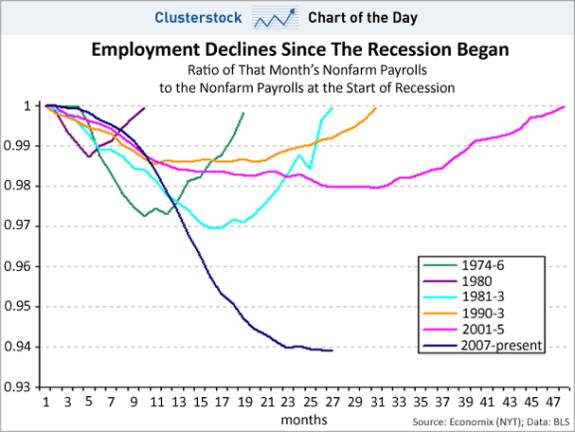

JOBS

Unemployment is historically high. This could be a repeat of the

20's and 30's. Back then, we no longer needed workers on the farms

because of increasing productivity. Ditto today with productivity

increasing everywhere outside of construction.

We somehow need to cut the workweek, employ more people at the same job and get paid

more. Right

now, half the equation is in place. The work week is contracting.

But cash flows from productivity gains are transferring through to the owners

of capital.(1) Wages however are stagnant-to-falling. If this continues and is magnified, it will likely

result in a sort of slow motion death spiral as the lower middle class is

destroyed.

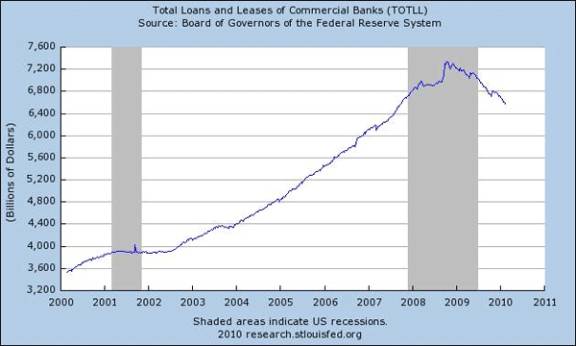

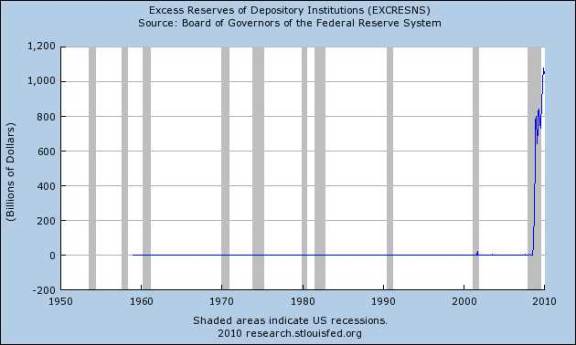

MONEY SUPPLY AND BANK LENDING

The government doesn't create very much money. The banks do that via

the fractional reserve system. When loans are increasing,

they increase by 10x (or more) the amount of government reserve dollars created.

But the Federal Reserve only has a 1-way control over the banks. It

can force them to restrict lending by pulling reserves out of the system.

Fewer reserves, less lending: (our father's recessions.) But

it cannot force banks to increase lending by making excess reserves available.

It is like pushing on a string. Even if the reserves are forced on

the banks (and they are - $1 trillion worth), if the banks don't want to

lend, or if borrowers don't want to borrow, then see the 2 charts below.

2001-2002 is the normal banking lending response to recessions going back

to 1945.

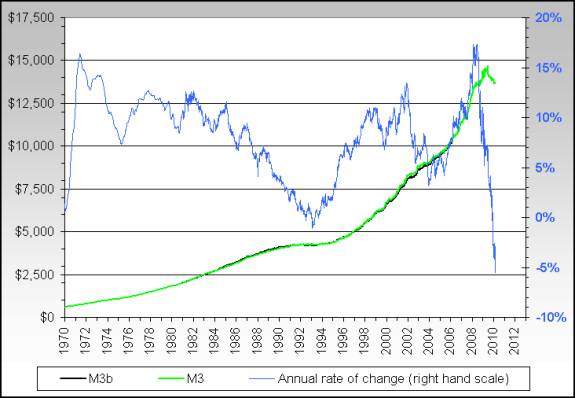

DEFLATION

When lending contracts, the money supply

contracts 10x. This is why the government's money printing

operations - Quantitative Easing - don't have immediate inflation consequences.

The fed is

printing $2 trillion while the banks are destroying $10 trillion.

The net is deflation. The only effect is to transfer the (bad) debt from private balance sheets

to the taxpayer's balance sheet. (How else would the banks pay

themselves obscene bonuses while destroying the country.)

![]()

Figure 1 M3 Money

Supply

OVERCAPACITY

When we borrow money and spend it on a car or a tv, a factory, a newly built house, start a business, etc., this borrowed money gets added into current GDP ie GDP is borrowed from the future. This is fine if, when the future gets here, we collectively borrow more and keep going. If at some point in time, borrowing begins to shrink (and this point will always come), the resulting contraction is very hard to stop. Capacity has been built to service a level of GDP that no longer exists. Asset prices decline, usually in a long and painful process. Think Japan in the 80's and 90's, England in the 30's, us, right now.

TOO MUCH DEBT

The stock market is up nicely, but this is, was, and will be, a credit

crisis. Simply put, there is too much debt and much of it cannot be repaid.

That is the long and the short of it.

Greece, to take an up-to-the moment example, won't be helped by more loans.

Their national debt has already reached escape velocity, where the interest

payments as pct of GDP exceed the growth rate of the economy. They don't

need less debt either, because this implies higher taxes and less

spending, throwing them into a good imitation of a depression. They

need to default and just refuse to pay the debt. For them, it is a

Hansel and Gretel moment: There is no way back from here. The

birds have eaten all the crumbs.

This is repeated in individual households across America, at shopping

malls, at office buildings, at state and local governments (whose only

option is to take the raise-taxes-cut-spending way out), and maybe, maybe

not, coming to the federal government in a few years. The only

segment of our society in good shape debt-wise is corporate balance

sheets. Corporations are mostly OK.

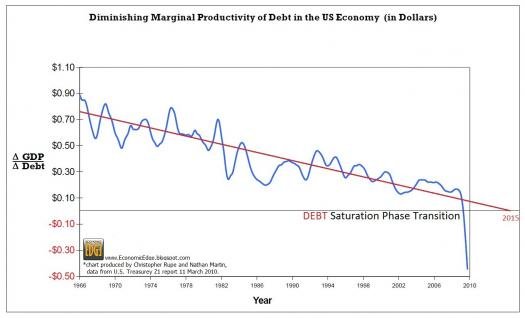

This chart shows what happens to US GDP when a dollar of debt is added into the economy.

THE BIG WORRY

The charts above may be approaching the bottom of a V, or more likely, an

L. But maybe not. L is probably the best case scenario that

can be hoped for and no more than 60-75% probable.

The country appears to be well and truly screwed for the next 5-10 years.

We inflate out way out, or go down in flames. But we have to worry

that Japan has been trying to create inflation in their economy for 20

years and they got zip. The Neikki is down 80% and real estate

likewise.

Of course the pain is binary. You loose your job, loose

your house, get divorced, move back in with your parents and you get

it. : You don't loose your job, your stocks go up, and you wonder what

all the fuss is about.

WHAT TO DO?

From Shelia Blair: current

Start with the details. Create a genuinely independent Consumer Protection Agency. Reinstate Glass-Stegall. Sounds like small stuff, but listen to her.

From Hugh Hendry: 1 year ago

Reestablish Glass-Stegall. End the fractional banking system. Only allow banks to lend out what they have in deposits. This is radical and is sine qua non for a steady state economy. Fractional reserve banking requires growth for one fundamental reason: The money is only created to fund the loan, nothing is put into the money supply to pay the interest. It is a game of musical chairs. If the music ever stops, there is not enough money to go around.

From Jeremy Grantham:. current

Reestablish the Glass-Steagall Act. Separate investment banking from commercial banking. If you don,t want to read it all, go to the appendix.

From me: Change the banks into public utilities. Just like Duke Power. Make them boring.

Will these reforms happen?

Not

likely. Our political system is corrupt to the core: To the

point that the participants look at what they are doing and don't even

think it wrong. What they take for good business practice would be a

class 4 felony if a building contractor tried the same thing. The

big banks own the thoughts of the politicians. Who is happy that

$3.7 billion will be spent on the midterm congressional

elections. The banks for one.

(1) Why this is a bad thing - Yves Smith Extolling the Corporate Squeeze of Workers

|

Year |

Mtg Pmt |

|

1 |

2,000 |

|

2 |

1,900 |

|

3 |

1,805 |

|

4 |

1,715 |

|

5 |

1,629 |

|

6 |

1,548 |

|

7 |

1,470 |

|

8 |

1,397 |

|

9 |

1,327 |

|

10 |

1,260 |

|

11 |

1,197 |

|

12 |

1,138 |

|

13 |

1,081 |

|

14 |

1,027 |

|

15 |

975 |

|

16 |

927 |

|

17 |

880 |

|

18 |

836 |

|

19 |

794 |

|

20 |

755 |

|

21 |

717 |

|

22 |

681 |

|

23 |

647 |

|

24 |

615 |

|

25 |

584 |

What 5% Inflation does to a $2,000 mortgage payment.

(Assuming you have a job and that

wages match inflation)